Wealth Management

Wealth Management

Wayfinding Financial is invested in You

Wealth Management isn’t a one-size-fits-all solution. It’s for individuals with complex needs who need help simplifying their lives.

Wealth Management provides sophisticated solutions to high net worth individuals and families. Request a consultation to explore the luxury and benefits of our Wealth Management Services.

Our Process

Let's build your wealth together

Starting with every Investor is unique. That’s why at Wayfinding Financial we work to identify all the ways in which your financial goals and objectives are encompassed in order to navigate you along the way. Our teams approach involves four stages:

Orientation

No matter what stage you are in your life, we start with establishing a more detailed understanding of you, to build a closer relationship. By gathering and reviewing detailed information your long-term financial goals and objectives will be determined to set the foundation of your desired destination.

Development

Our goal is to make sure your financial goals and objectives are in line with your expectations. Once we have a thorough understanding of what you want to achieve we can implement a personalized plan that allows us to measure, track, and update as life changes.

Selection

Our desciplined investment approach is the foundation in implementing and maintaining your personalized plan. We have built a wide range of portfolios designed to help clients like you meet their financial goals.

Monitoring

We do not stop once your plan is in motion. Continues monitoring and updating to address economic and market conditions, changes to your long-term goals, and unexpected "Life" events are essential to your long term success. Life is unpredictable and always changing that is why we engage regularly to adapt your plan as life unfolds.

The Wayfinding Approach

Expanding on the options traditionally available to individual investors, we are able to better customize portfolios to meet each client’s unique needs.

Asset allocation

Today’s well-diversified portfolio go beyond traditional stocks and bonds, often including alternative assets. This adds complexity to the portfolio consturction process.

We assess each asset-class sleeve separately, managing complexity and ensuring risk and reward is managed within each dimension of the portfolio.

Investment selection review

We customize our approach to suit your needs. Whether you hire us to manage a diversified portfolio or to focus on a particular area, our nimble approach is designed to be dynamic to your goals.

We help you steam-line the investment process by monitoring current asset managers and finding new investments opportunities.

Risk management

With our industry-leading analytical tools, we offer a comprehensive risk assessment including multi-factor analysis, stress and scenario testing, and other key metrics for a full picture.

Our advisors can deliver tailored data interpretation for your risk/reward thresholds.

Information Security

Your personal information is safeguarded through an information security technology stack that offers 2-factor authentication as well as password and end-to-end email encryption.

Digital Onboarding

We streamline the onboarding and information gathering process through digital platform that pre-populates information and eliminates the hassles of physical paperwork.

Real-Time Portfolio Access

You get access to a consolidated view of your global portfolio in real-time via performance software that is customizable and can be conveniently viewed via desktop, mobile, or tablet.

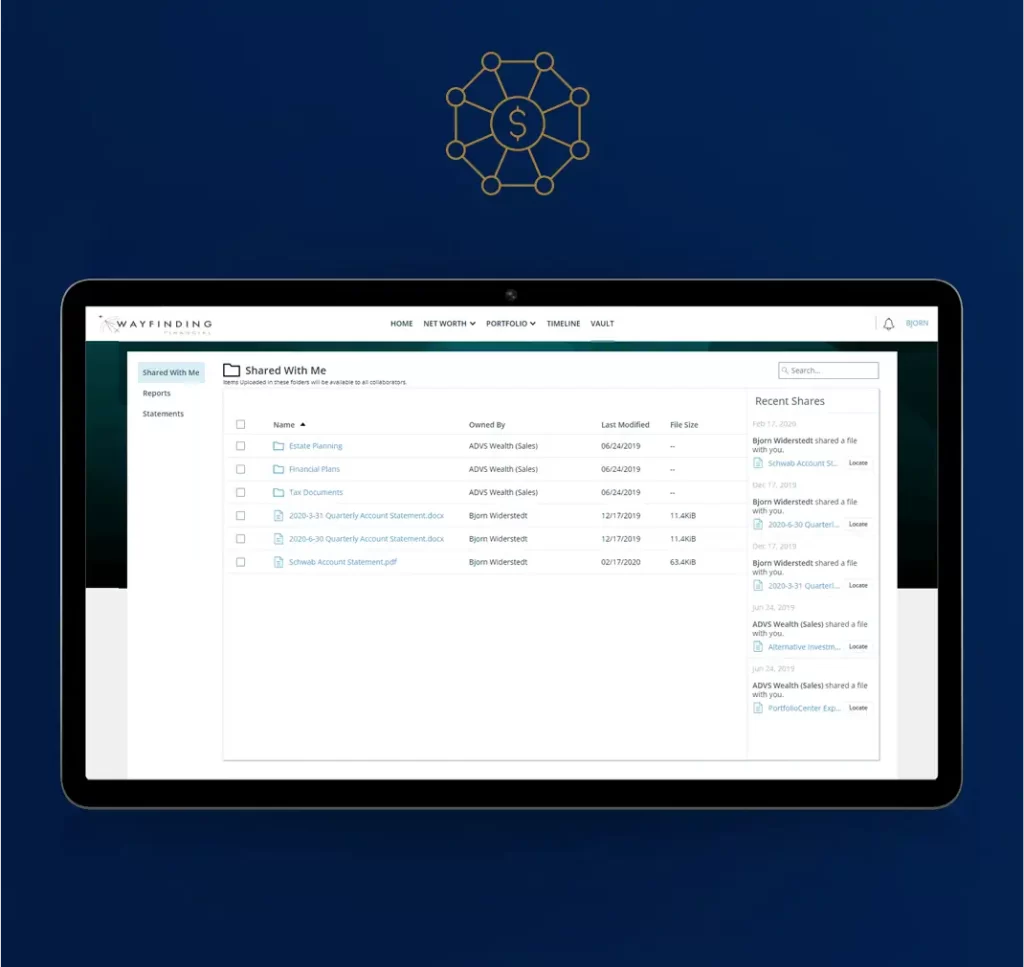

Document Vault

Our online document vault syncs with your accounts to consolidate tax documents such as K-1s and 1099s in a location that is easily accessible for you and your tax advisor.